Temporary van insurance

Cover in no time

Takes less than 60 seconds!

Why choose Covertime?

Comprehensive van cover

Docs available immediately after purchase

Quick and flexible

Cover from one hour to 28 days

Protect existing No Claims Discount

Do everything online

Insure only for the time you need

Get on the road in minutes

What is temporary van insurance?

Temporary van insurance is a short term, flexible alternative to traditional annual van insurance policies.

It allows you to insure a van for a specific period of time. It's perfect for one off jobs, emergencies or occasional use. It may also be referred to as temporary commercial vehicle insurance.

You only pay for the time you need, with no long term commitments, plus you can start cover straight after you've paid or a selected day and time within the next 30 days!

Our short cover van cover from Covertime is comprehensive so it will cover the van you are using, as well as damage or injury to other people, vehicles and property.

From as little as one hour to up 28 days, you can get insured quickly and legally to drive a van anywhere in the UK.

Insurance on a van in the short term can be very useful in a variety of situations:

Transporting large furniture or items

Moving house or helping someone else relocate

Business use in connection with your trade including the carriage of tools and materials

Emergency use if your van is off the road

Driving a new van home before you arrange an annual policy

Test driving a new van before you buy it

Driving a friend's or family member's van

Our van policies are Comprehensive

What is covered?

Damage to the van you're driving

Theft or attempted theft

Fire damage

Third party: damage to other vehicles / property / injury to others

What isn't covered?

More than one driver on a temporary policy

Delivery, courier or taxi work

Theft or damage due to neglect; such as leaving the van unlocked

Wear and tear or windscreen

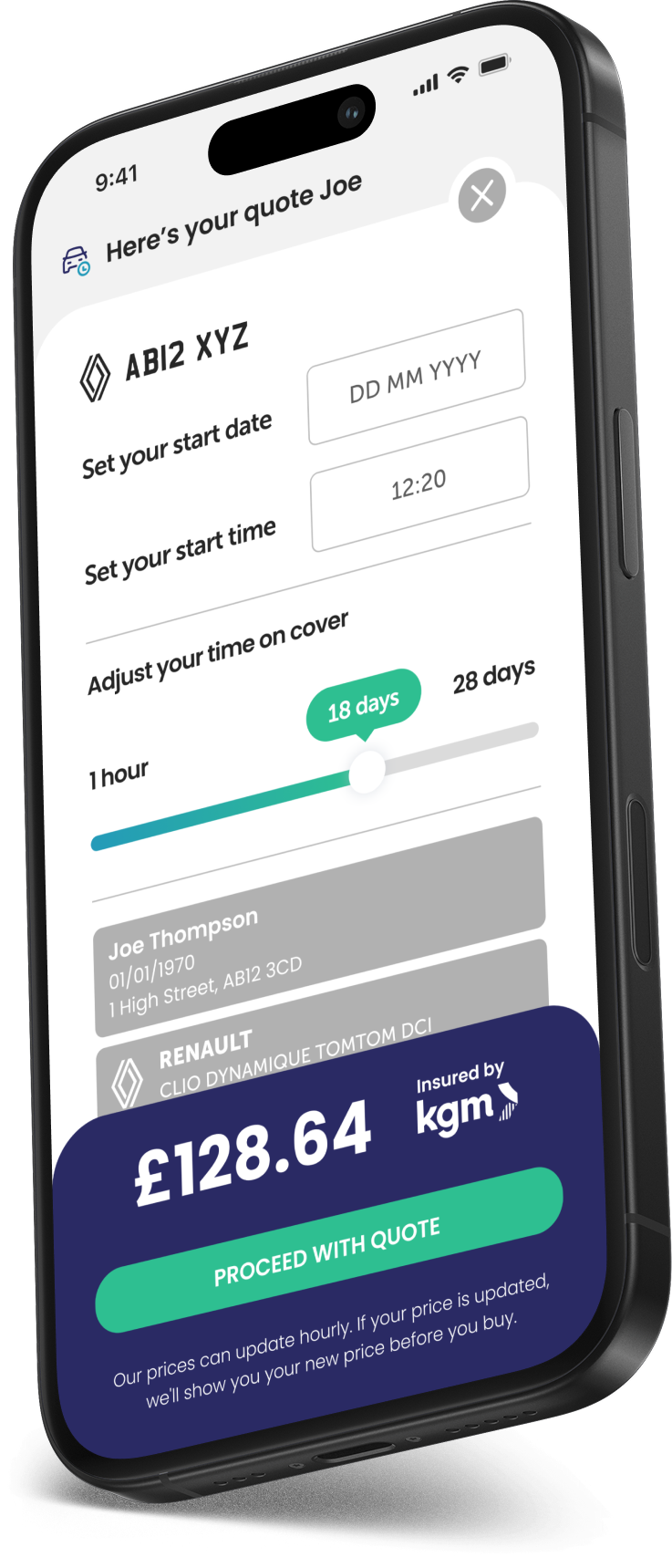

How to get temporary van insurance

Getting temporary van insurance can be done in just a couple of minutes!

You can get a short term van insurance quote in under one minute with our easy, quick quote process. Whether you’re borrowing a van for a house move, running a quick job, or picking up large items, temporary van insurance gives you the protection you need, only for the time you actually need it...

1

Just let us know the van's reg and a few details about yourself

2

Then we need to know when you need the cover and how long for

3

Get your quote, check the terms, choose how you want to pay and you're off!

Do I need temporary van insurance?

If you only need to drive a van for a short period, then yes – temporary van insurance is likely the best option. It’s ideal for one off situations like moving house, helping a friend relocate, transporting large furniture or test driving a van before buying.

Rather than committing to a full annual policy, short term cover gives you the flexibility to insure a van for just the time you need; whether that’s for an hour, a day, or a few weeks.

You might also need temporary van insurance if your own van is off the road and you’re using a replacement, or if you're heading to an event or festival and want a bigger vehicle just for the trip.

One of the biggest advantages of temporary van insurance is that it could save time and money. Instead of being added to someone else's annual policy, which can be expensive and affect their no claims discount, you get your own comprehensive cover. This keeps things simpler and ensures you're protected without the added hassle or cost.

So, if you're borrowing a van, lending one out, or just need occasional access to a van for personal reasons, temporary van insurance is a smart, cost-effective solution.

You may need to add a driver for your van for van for a specific job for a one day or one week. Perhaps you need to borrow a van for a larger load. Temporary van insurance is perfect for business usage and carrying good that are related to your business. It's not suitable for carriage or other people's good, such as delivery or courier work.

Covertime's temporary van insurance is only suitable for drivers with a maximum of three penalty points with no previous claims in the last three years.

It gives you instant cover, total peace of mind, and complete flexibility... exactly when you need it.

Who is temporary van cover suitable for?

Carriage of own goods

Ages 22-69

Full UK licence holders

Max value £40,000

*Other terms and conditions apply.

How much does temporary van insurance cost?

The premium you’ll pay for your short-term van insurance will depend on several factors, including your age, driving experience, location, the time and date you need cover, the van you’ll be driving, and how long you need to be insured for.

If you only need to drive a van for a short period, a temporary van insurance policy can be an affordable and flexible option. However, keep in mind that the longer the duration of your cover, the higher the cost is likely to be.

You can take out multiple temporary van insurance policies throughout the year, especially if your driving needs are occasional or vary. But if you find yourself regularly using the same van, switching to an annual van insurance policy could work out more cost effective in the long run.

How can you get cheap temporary van insurance?

In order to get the cheap temporary cover on your van: only pay for the time you actually need to drive.

One of the biggest advantages of insurance in the short term is its flexibility. You can start your cover at the exact moment you need to drive and set it to end as soon as you're done. This way, you're not paying for unused time, keeping your costs as low as possible.

By insuring yourself on a van only for the specific period you need it; whether it’s for a quick delivery, a weekend move, or a short work project, you avoid the higher costs of unnecessary, longer-term policies.

You can choose cover from as little as one hour, up to 28 days. If you need more time later, simply take out another policy, it’s quick, easy, and designed to work around your schedule.

Temporary van insurance specialists

We're specialists in short term van insurance...

We might be a newer name in the world of temporary insurance, but when it comes to short term van insurance in the UK, we know exactly what we’re doing. Our team has decades of experience in the insurance industry, many of us have spent over 20 years specialising in temporary cover. That experience led us to launch Covertime, a fresh, modern take on short-term insurance that’s built to do things better.

We’ve seen what works (and what really doesn’t) when it comes to temporary insurance. So, we created Covertime to fix the frustrating bits and make van insurance fast, flexible, and simple.

With short period van insurance in the UK from Covertime, you can choose how long you need cover for; from just a few hours to several days or weeks. Whether the van’s yours or someone else’s, getting insured is quick and painless.

It takes less than 60 seconds to get a quote. We've stripped away as many questions as we could and made the whole process as smooth as possible.

We don’t run a massive call centre with long hold times, we’ve made it so easy to arrange your cover online, you can do everything online! If you do want help, our friendly live chat team is right here. Prefer to talk to someone? Just ask and we’ll call you back.

We’re proud to offer UK van drivers one of the fastest, easiest ways to get on the road legally and confidently. Covertime is here to make temporary van insurance hassle free, and we think it might just become your new favourite way to insure your van on a temporary basis.

Benefits of temporary van insurance

Quick, easy and affordable

Get a quote quickly, with a minimal amount of questions for just the length of time you need to drive the van to keep costs to a minimum.

Great for short term tasks

Need to move house or pick up some large large furniture or item? Short term van insurance is perfect

Choose your time

You decide when your cover starts and ends, providing complete control and flexibility.

Comprehensive cover

Our short term van insurance protects you, your passengers, your van as well as other people, property and vehicles.

Which types of vans can you insure short term?

We can cover a huge variety of vans with our temporary van insurance UK up to a maximum value of £40,000.

Just enter the registration of the van and some details about you, then we’ll do the rest!

No need to hunt down the exact make, model, engine size or value; we’ve got clever tech that looks up the van’s details in a flash.

Small Vans

Compact and efficient – ideal for city driving, light deliveries, or sole traders needing flexibility.

Examples: Ford Transit Courier, Citroën Berlingo, Peugeot Partner, Renault Kangoo, Fiat Doblo, Vauxhall Combo, Volkswagen Caddy

Medium Vans

The perfect all-rounder. A good balance between load space and drivability, suited for trades and daily work.

Examples: Ford Transit Custom, Vauxhall Vivaro, Peugeot Expert, Citroën Dispatch, Renault Trafic, VW Transporter, Toyota Proace

Large Vans

Built for bigger jobs. Excellent for heavy loads, long wheelbasesand some conversions.

Examples: Ford Transit, Mercedes Sprinter, Volkswagen Crafter, Renault Master, Fiat Ducato, Peugeot Boxer, Iveco Daily

Crew Vans (Double Cabs)

Combine passenger and cargo space – great for moving both your team and your tools.

Examples: Ford Transit Custom Double Cab, Vauxhall VivaroDoublecab, Mercedes Vito Crew Van

Luton Vans

Box-style vans with huge internal space, ideal for removals or transporting bulky goods. Often come with a tail lift.

Examples: Ford Transit Luton, Mercedes Sprinter Luton, VW Crafter Luton, Renault Master Luton

Electric Vans (EVs)

Zero-emissions and increasingly popular for urban deliveries. Cheaper to run, cleaner to drive.

Examples: Vauxhall Vivaro-e, Renault Kangoo E-Tech, Ford E-Transit, Mercedes eSprinter, Citroën ë-Dispatch, Peugeot e-Expert, Nissan Townstar EV

Whatever van it is that you drive, simply pop your registration plate into our site and we'll get your temporary van insurance quote seriously fast and get you covered in minutes.

What levels of cover does temporary van insurance have?

When you buy annual van insurance, you usually choose from three types of cover. These are Comprehensive, Third Party Fire and Theft (often called TPFT), and Third Party Only (TPO), which is the minimum you need to drive legally in the UK.

Third Party Only covers damage or injury caused to other people, their vehicles or property. It won’t cover any damage to your own van. TPFT offers the same cover as TPO, but it also protects your van if it’s stolen or damaged by fire.

Comprehensive cover offers the most protection. It includes everything in TPFT and TPO, plus it covers damage to your own van too.

When you take out temporary insurance on your van with Covertime, we only offer Comprehensive cover, which is the highest level of cover available out of the three main UK cover levels of Third Party Only, Third Party Fire and Theft and Comprehensive.

What cover and uses should I be aware of for temporary van insurance?

Can you use temp van cover for Commuting?

Temporary van cover can be used for commuting. For insurance purposes, commuting means driving to or from a single, regular place of work. This includes part of the journey, such as driving to a train station as part of your commute.

Can you use temporary van insurance for Personal Business Use?

Yes you can use temporary van insurance for Personal Business Use and carrying your own goods. This means that you cannot use short term van cover for delivery or courier work, but you can use it for your own business to transport your own tools, goods or belongings.

Can you use temporary van insurance for Commercial Use?

You cannot use temporary van insurance for commercial use. Commercial use means using your van to transport goods or people for hire or reward.

Can I use temp van insurance in Europe?

Yes, you can use short term van cover for driving in Europe, but your trip must begin and end with the van in the UK. The insurance gives you comprehensive cover in the UK, but when you’re in Europe it will only provide the minimum level of cover that is required in the country you are driving in.

Make sure you check what that minimum level is before you travel. In most European countries, this will be Third Party Only. It’s important you also doublecheck any extra requirements in your policy booklet before you set off.

You can view our IPID on our quote page before you purchase a short term van policy which shows the country exclusions and inclusions. You can view our Policy Wording on our declaration page before purchasing a van policy, where you can read the full terms and conditions of the policy.

How do I know my van is insured when using temporary van insurance?

We work with a trusted panel of insurers who have experience in offering short term cover to UK drivers.

Just check the confirmation email we send you and read the documents enclosed for full details of your policy.

You can also check the Motor Insurance Database (MID), which is the UK’s official record of insured vehicles. Due to the fact that short tern van insurance starts quickly, your policy might not appear on the MID straight away. As long as you have your certificate, you are insured and safe to drive.

Pay securely and easily

Temporary van insurance FAQs

No you can't take out temporary insurance on a hired van. Short term insurance allows you to borrow a van and insure it, rather than insure a hired van.

You cannot legally drive a new van home without insurance. If you have an accident you won't be insured, even if it is new and you haven't sorted a new policy yet. Short term van insurance is very easy to set up from anywhere, so you want to avoid ever driving without the appropriate insurance required by law.

To get temporary insurance from us at Covertime, you'll need to have a full UK driving licence for at least 12 months.

Yes you can take out multiple temporary van insurance policies in a year, but there will come a point that if you're always insuring the same van, that an annual policy would be more cost-effective.

It’s important to know what temporary van insurance does not cover. You’re only insured for the carriage of your own goods. This means it's suitable for personal use or transporting your own tools and equipment. It does not cover any form of hire or reward, including courier work, delivery driving, or using the van as part of a delivery service. If you're earning money from transporting goods, you'll need specialist commercial or courier insurance instead.

You’re also not covered if you're driving a hired or rental van, a specific rental vehicle insurance policy is required for that.

The van must be physically located in the UK at both the start and end of the policy. Short term van insurance is not valid for importing or exporting vehicles or for driving outside of the UK, EU, or EEA.

Yes you can use temporary van insurance to get an MOT on your van, but it must be for a pre-booked MOT appointment.

Yes you can insure a van for just one week. Temporary insurance for commercial vehicles is completely flexible, not only does it allow you to drive the car of a family member or friend, it allows you to choose the exact amount of time you need to use the car for.

You can insure a car for as little as one hour to 28 days.

Short term van insurance is a useful option if you need emergency cover to make sure you’re driving legally on UK roads. If you get behind the wheel of a van without insurance, you risk serious trouble if you’re stopped by the police.

It can also come in handy if you need someone else to use your van for a short period, don’t take the chance of risking it and letting someone borrow your van without being properly insured.

The risks are even greater if you have an accident without insurance. You could face large costs if you’re found responsible for damage or injury, as well as legal penalties for driving uninsured.

If you crash a van in the UK without insurance, you’re breaking the law and could face serious penalties. It’s illegal to drive without at least third party cover, and even if the van itself is insured, you must have your own insurance to drive it.

If you’re caught, you could get a £300 fine and 6 points on your licence. In more serious cases, you could face an unlimited fine, a driving ban, and the police might seize or destroy the van. Short term van insurance is a simple way to avoid this.

After purchasing your temp van insurance policy from us, you'll receive a set of important documents to view and download.

These include your Insurance Certificate (proof of cover), Policy Schedule (key policy details), Statement of Fact (information used to create your policy) and the Policy Wording (full terms and conditions).

You’ll also get an Insurance Product Information Document (IPID) for comparison purposes, our Customer Terms of Business, and the Covertime Contract, which outlines our role in arranging your policy and the admin fee payable.

There’s no fixed rule for which vans are the cheapest to insure short term. But in general, smaller and less powerful vans tend to have lower premiums.

If you’re after the cheapest temporary van insurance, it’s worth getting quotes for smaller models or older vans. Examples of vans that might fall into this category include the Ford Transit Connect, Vauxhall Combo, Citroen Berlingo, Peugeot Partner, or Renault Kangoo.

No, you don’t earn a No Claims Discount (also called a No Claims Bonus) with temporary van insurance in UK. This is because short term policies only last from one hour up to 28 days. No Claims Discount is something you build up after a full year of claim-free driving on an annual policy, which is why it doesn’t apply to temporary cover.

There’s no set rule for what security will lower the cost of temporary van insurance in the UK. The same applies to short term cover as it does for annual policies.

The best way to protect your van is to use several layers of security. No single device can guarantee your van won’t be stolen. You could use an alarm, an immobiliser to prevent the van being started, a tracker to help find it if it’s taken, or physical security like a steering wheel lock. Parking behind a bollard or keeping the van in a locked garage can also help.

While determined thieves can get past most measures, the more security you have, the harder you make it for them and the more likely they are to be put off.

The safest option is to keep your van locked away in a garage overnight. This keeps it out of sight from opportunist thieves and adds a physical barrier they would have to get through without drawing attention.

If you don’t have a garage, parking on a driveway is the next best choice. While there’s no barrier, it keeps your van close to your home so you’re more likely to hear if anything happens.

If a garage or driveway isn’t available, parking on the road is the last resort. From an insurance point of view, this is the least secure option, as your van will be more exposed and not behind a locked door.

When you get a temporary van insurance quote with Covertime, we use your registration number to look up the details of your van. This means you don’t need to work out its value or worry about things like depreciation since you bought it. Our system handles it for you.

There’s no need to calculate what you paid, how old the van is or how its condition or mileage might affect the value; but be sure to carefully check the maximum indemnify limit listed in the insurer’s declaration on the terms and conditions page.

Most temporary van insurance providers offer cover from one hour up to 28 days, so six months is longer than what short term policies provide.

If you’re thinking of cancelling an annual policy part way through, keep in mind that you may have to pay a cancellation fee, you won’t earn a year’s no claims discount, and the refund is unlikely to match six months’ worth of unused cover. It’s always best to check with your insurer first to understand any costs or other effects before making changes.

We can only offer temporary insurance on a van if you hold a full driving licence. You’ll also need to have had your licence for at least six months before we can provide a short term van cover quote.

Here at Covertime we required you to have a full UK driving licence to be able to take out our temporary van insurance. We cannot currently provide short term van insurance for non-UK driving licence holders.

You can insure yourself to drive a friend’s van with short term van insurance in the UK (with the owner's permission of course!) If you need to use a friend’s van, simply get a short term insurance quote from us today and be ready to drive within minutes.

The process is quick and straightforward; most people get a quote in under a minute, as long as you have your driving licence and the van’s registration details ready.

With short-term van insurance you can legally and safely insure yourself to drive a van that isn’t yours. The main advantage is that you only pay for the time you actually need to be covered, which could potentially save you money.

If you find you need to drive the van for longer than planned, you can simply take out a new temporary van insurance policy to stay fully covered for the remainder of your journey.

We’ll also send you a reminder email before your policy expires, making it easy to purchase another policy by following the link back to our site.

Temporary van insurance cannot be transferred between vehicles or drivers, because these policies are designed to be flexible and straightforward. The simplest option is to get a new shortterm policy for the different van or driver. If your current policy hasn’t started yet and you no longer need it, you can get in touch with us to discuss a possible cancellation and refund, provided cover has not started.

Unfortunately, you cannot insure a modified or custom van, such as a campervan using our temporary van insurance.

Temporary campervan or motorhome insurance is different product, and you will need to insure such vehicles with the correct policy to cater for the usage and specifications of your vehicle.

You can insure more than one van with temporary insurance, but you will need to insure each vehicle on its own policy. Therefore, you could have one temporary policy on one van and then have another temporary policy on another van. It would not be van fleet insurance, but instead multiple short term van insurance policies.

At Covertime, we’ve made the process simple enough that you won’t usually need to talk to anyone. However, we are available via Live Chat and email if you have questions. If you prefer, you can contact us, and we’ll call you back by phone.

Please be aware that we can’t set up the policy over the phone, you’ll need to get your quote online. Our online quote process is quick and typically takes less than a minute to see your price.

When you take out a short term van insurance policy with us, we will send you all of your insurer documentation via email immediately. If you’re involved in an incident that may result in a claim, contact your insurer directly as they will handle the process. Your documents are provided on the Policy Confirmation for you to download / screen grab / print and also sent via email.

If you need help, our team is here to assist. Claims should be reported to your insurer as soon as possible.

Temporary van insurance can often be cheaper because you only pay for the period you actually need cover, whether that’s for a few hours, a day, or several weeks. Unlike annual policies, you’re not locked into a long contract or paying for coverage you’re not using.

Many providers offer temporary van insurance through efficient online systems, cutting down on administration costs and making the policies more cost-effective and flexible for drivers.

Yes, you can insure a van for occasional use. This type of insurance is designed precisely for people who only need to drive a van now and then, rather than all the time. It is called temporary van insurance or short term van insurance.

The idea is that you only pay for the time you actually need to be covered, whether that’s a few hours, a day, or a few weeks.

This makes it a flexible and affordable option if you don’t use the van regularly or only need it for specific trips. It’s also useful if you want to drive a van that isn’t your own, perhaps a friend’s or a work vehicle, without committing to a full annual insurance policy.

Temporary van insurance UK is popular because it provides the legal cover you need without the cost and commitment of a long term contract. It’s simple to arrange online, usually with a quick quote process that lets you get insured in minutes.

So, if you only need insurance for a short time or occasional trips, temporary van insurance is worth a look.

Did you know?

Driving other cars using an annual policy usually only insures you for Third Party claims, meaning damage to the car you are driving is not covered.